Efficacy of Microfinance in Development of Slum Areas- Study based on

Barasat Municipality of North 24 PGS District in West Bengal.

Association of Micro Finance

Dr. Chandan Kumar Maity

Institution - West Bengal

Program Officer-

Research and Documentation,

AMFI - WB

Kolkata, West Bengal, India

September, 2019

1. Introduction:

In general poor people in West Bengal are engaged in herding activities, fish folk sellers,

operating micro enterprises where goods are repaired, recycled, work for wages in small

industries, working in others home as maid or cook, involving in stitching activities, small kiosk

centre etc. These poor people hesitate to enter in bank. They are unable to understand the papers

or documents formalities for small amount of loan. Microfinance institution approaches to

people after which people take advantages of credit facility who are registered with it.

The 1990s was marked by a debate between two approaches to microfinance, the "financial

systems" approach and the "poverty lending" approaches (Robinson, 2001). While the former

emphasized institutional sustainability, the latter emphasized poverty reduction. Rhyne (1998)

described poverty and sustainability as the "yin and yang" of microfinance, implying that they

are two sides of a whole, each incomplete without the other. She pointed out that ultimately

members of both camps had the same objective, namely that of increasing outreach. Gibbons and

Meehan (1999) pointed out that while the need for sustainability has been by and large accepted,

there is less clarity on how to approach it without losing sight of the poverty reduction goal. This

issue was brought into sharper focus when post-2007, MFIs began to raise equity from

commercial sources. However, as commercial investors are by definition profit oriented, their

involvement in the ownership of the MFI raises the prospect of changing its focus from social to

commercial objectives, commonly referred to as "mission drift"1. Microfinance is provided by

commercial banks, Regional Rural Banks

(RRBs), the SHG’s, cooperative societies and

institutions (MFIs) that take various forms, including those of NGO’s and Non-Bank Financial

Institutions (NBFI’s). Banks and NBFI’s are governed by the Reserve Bank of India (RBI),

SHGs are regulated by NABARD, and the cooperatives are governed by Registrar of

Cooperative Societies (RCS) etc. The reports presented by the Committee on Financial Inclusion

chaired by Dr. C. Rangarajan in 2008 (Government of India 2008), and the Committee on

Financial Sector Reforms chaired by Dr. Raghuram G. Rajan in 2009 (Planning Commission

1 Mission drift may manifest itself in various ways, such as by MFls serving more well-off segments of the

population or by MFls charging higher rates of interest

2

2009) discuss the state of financial exclusion despite initiatives to encourage financial inclusion.

Though these directives are a welcome move in the previously unregulated microfinance sector,

the adequacy of mandates related to ‘Multiple-lending, Over-borrowing, and Ghost-borrowers’

in tackling the problem has not yet been investigated.

Microfinance institutions approach to poor people of slum areas and open the way for them by

providing micro loans. Various microfinance institutions like L & T Finance, Muthoot Finance,

Village Financial Services limited, Uttarayan Financial Services private limited, Arohon,

Bandhan, BIFL and many more ore operating in West Bengal. These microfinance institutions

provide loan to poor in group of minimum 5 and maximum 16. Beneficiaries are required to pay

interest on loan amount in weekly basis or in fortnight or on monthly basis. With the help of this

loan amount these poor people establish their own business, some of them give such amount to

their husbands for setting up of new or further expansion of their business or some of them use

that money in their existing business. This facility of micro financing helps the poor people to

live a comparatively better quality of life in the people of the sample area.

This research work is performed to study the Effectiveness of Microfinance in development of

slum area of Barasat Municipality in West Bengal state. The result of this study was intended to

give a better understanding of the major factors which represents the effectiveness of

microfinance in the development of the said area in Barasat.

Considering the nature and objective of the research, explanatory research method was adopted.

The major objective of the research is to analyze effectiveness of microfinance. Data is indeed

the most important part of any explanatory study. For the collection of the data, a questionnaire

was designed in order to address issues related to demographic features, social features and

economic functions. For the purpose of the study, 100 respondents from Barasat Municipality

have been selected from various MFI. The numbers of respondent from the selected MFI are

listed in Table 1.1.

3

Table 1.1: Name of the selected MFI and number of respondent:

Sl.

Name of the MFI

Respondent

Hindu

Muslim

No

1

Bandhan

11

04

07

2

Uttarayan Financial services Pvt. Ltd.

11

11

00

3

Village Financial Services

11

00

11

4

L & T financial Services

11

11

00

5

Jagaran

11

11

6

ASA International

11

11

00

7

Ahoron

11

00

11

8

BFIL

11

04

07

9

Muthoot

12

07

05

Total

100

59

41

2. Demographic Profile of the respondent

Demographic information provides data regarding research participants and is necessary for the

determination of whether the individuals in a particular study are a representative sample of the target

population for generalization purposes. In this section, the study enlisted the characteristics of the sample

households such as religion, cast, marital status, age group, and education etc. of the borrowers.

2.1 Religion and Cast

With the help of a well-equipped questionnaire the study is based on 100 selected respondents

who are the microfinance users in the selected area. From the 100 respondents of the selected

microfinance users in Barasat Municipality, it is found that all the respondents are female.

Among them 59% are from Hindu and 41% are Muslim. The ratio of Hindu to Muslim is 5.9:4.1

.Thus the microfinance institutions are encouraging the female members from both the Hindu

and Muslim community of the slum area in Barasat municipality.

Table2.1: Religion of the respondents.

Religion

Hindu

Muslim

Gender

Male

Female

Male

Female

Respondents

00

59

00

41

Percentage

00

59%

00

41%

4

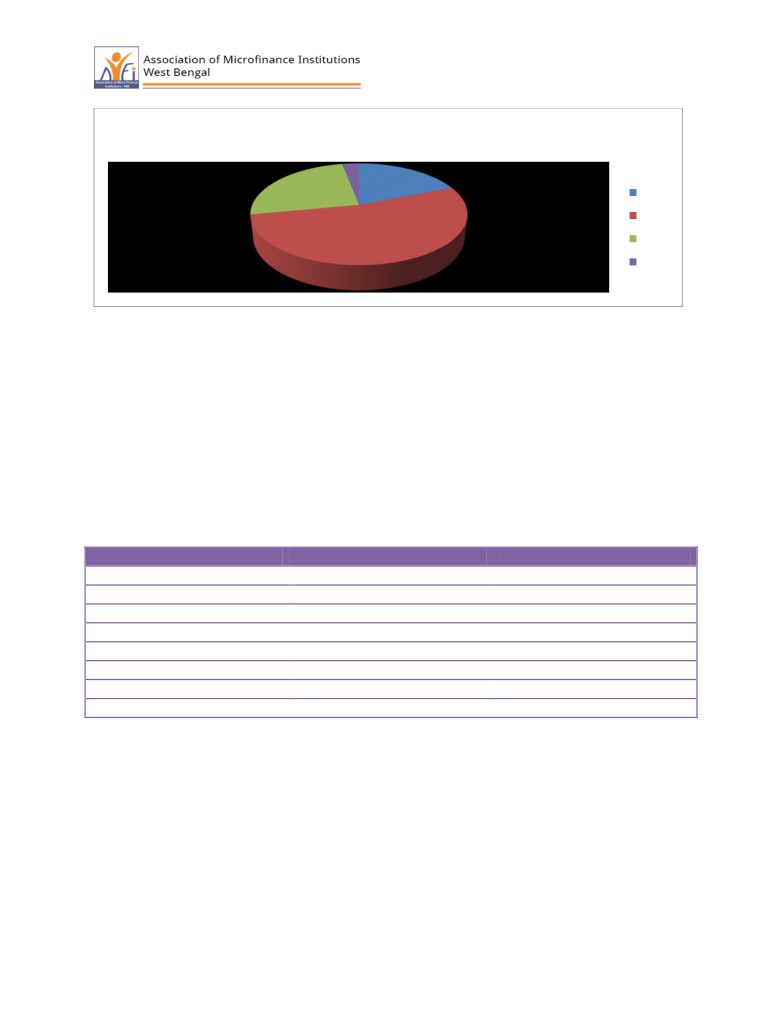

Religion

Cast

General

Hindu

SC

Muslim

OBC

Monority

Among the respondents the highest percentage of borrowers are from minority group followed

by unreserved people. The percentage of respondent from schedule Cast and other backward

class are very few. It has been also observed that there are no respondent from tribal community.

Table2.2: Caste wise classification of the respondents

Caste

General

38

38%

SC

18

18%

ST

00

0%

OBC

03

3%

Minority

41

41%

2.2 Marital Status:

From the 100 respondents of microfinance users in slum areas of Barasat municipality, it is

found that maximum numbers are married. It is shown in table 2.3. Out of 100 respondents, 95

percent of respondents are married.

Table2.3: Marital Status

Marital Status

Number of respondents

Percentage

Single

00

0%

Married

95

95%

Divorce

4

4%

Widow

1

1%

5

Merital Status

Married

Divorce

Widow

2.3 Age Group of Respondents:

The slum microfinance users’ age group 18 - 60 was the sample unit. In the selected sample

highest respondents were age group of 26 - 35 years and which was 53% of the sample size. If

we see the youth category (18 - 35 years) then 62% microfinance users were young. If we

glimpse over the data shown in table 2.4, we found that nearly 87% of the respondents are in the

age group of 36-45 years. About 13 % of the respondents are in the age group of 46 and above.

Table 2.4: Age group of the respondent

Age group

Frequency

percentage

Cumulative percentage

18 - 25

19

19%

19%

26 - 35

53

53%

62%

36 - 45

25

25%

87%

46 - 55

03

3%

100%

56 and above

00

0%

100%

Total

100

100%

6

Age Group

18-25

26-35

36-45

46-55

2.4: Level of education:

It was found in table 2.5 that out of the sample size of 100, a good number of micro finance users

completed secondary level of education. If we take the cumulative frequency of users who can

read write and understand (i.e., up to graduation), we come to know 81% of the respondents

come under these category. There are still some people who are illiterate (19%).

Table2.5: Level of education

Education

Frequency

Percentage

Illiterate

01

1%

Illiterate but can sign

18

18%

Primary

20

20%

Secondary

57

57%

Graduation

04

4%

Post graduation

00

-

Technical

00

-

Others

00

-

7

Education

Illiterate

Illiterate but can sign

Primary

Secondary

Graduation

2.5: Occupation status:

From the data it is seen that after availing microfinance, 45% respondents are self employed.

Now only 4% slum dwellers are maid servant, 3% are working as cook.

Table2.6: Occupation status.

Status

Frequency

Percentage

Housewife

55

55%

Tailor

8

8%

Garment trader

4

4%

Grocery shop

9

9%

Street vendor

5

5%

Other small business

12

12%

Cook

3

3%

Maid Servant

4

4%

8

Housewife

Tailor

Garment trader

Grocery shop

Street vendor

Other small business Cook

Maid Servant

3. Functioning of Microfinance users of slum areas of Barasat Municipality

In this section we have analyzed functioning of microfinance users in the sample area of study. It

includes reasons of availing microfinance, sources of information of microfinance, duration of

association of microfinance users with the listed MFIs, amount of loan acquired by microfinance

users, installment facilities for repaying loan, investment mechanism, investment area etc.

3.1 Reasons of availing microfinance

There are also many theoretical reasons for joining microfinance, such as easy availability, easy

processing of loan, installment facility of loan repayment, low interest rate, availability nearer to

residence and expansion of business. Out of the selected microfinance users 78% of the users

have joined these microfinance programmes to the fact that it adopts a hassle free process to

sanction loan. 35% of the users have joined as the MFI offer loans to the low income people and

27% takes loan from MFI due to the fact that it does not demand the security to sanction loan.

Table 3.1: Reasons of becoming a part of MFI

Possible Reasons

Frequency

Percentage

It adopts a hassle free process to sanction loan

78

78%

Does not demand the security to sanction loan

27

27%

Sanction loan at relatively low rate of interest

20

20%

It provides loan to low income people

35

35%

Other people have increased their income through this

17

17%

Others advice you

17

17%

9

Possible Reasons

Others advice you

Other people have increased their income through…

It provides loan to low income people

Sanction loan at relatively low rate of interest

Does not demand the security to sanction loan

It adopts a hassle free process to sanction loan

0

10

20

30

40

50

60

70

80

90

3.2: Sources of Information:

The table 3.2 shows the sources of information with respect to microfinance. It shows that

majority of respondents (i.e., 47%) get information from their friends and neighbor. Family and

relatives of the microfinance users also give information about the microfinance (20%). As

members of microfinance are connected with other members also, they want others to be

involved and avail these services of microfinance. Therefore one of the major sources of

information of microfinance is of friend circle which counts to 47%. The other sources include

group member and MFI staffs.

Table 3.2: Sources of information with respect to Microfinance

Source

Frequency

percentage

Cumulative

Group

21

21%

21%

Friends/neighbor

47

47%

68%

Family/Relatives

20

20%

88%

MFI staff

12

12%

100%

10

MFI staff

Family/Relatives

1

Friends/neighbor

Group

0

10

20

30

40

50

3.3: Duration of Association in Microfinance users.

The duration of association of users with microfinance is very important. The findings of the

below table exposed that majority of microfinance users have associated with microfinance for

the period of 1 to 3 years. Around 11% of respondents state that they are associated with

microfinance institutions within one year. While 22% of the respondents declared that they have

joined microfinance programme for 3 to 5 years and only 11% are availing the services of

microfinance for more than 5 years. This specifies that services of microfinance has been

increased and are more in demand.

Table 3.3: Duration of Association with MFI

Period of Association

Frequency

Percentage

Within 1 year

11

11%

For last 1 to 3 years

56

56%

For last 3 to 5 years

22

22%

More than 5 years

11

11%

Total

100

100

11

Period of Association

60

50

40

30

20

10

0

Within 1 year

For last 1 to 3

For last 3 to 5

More than 5 years

years

years

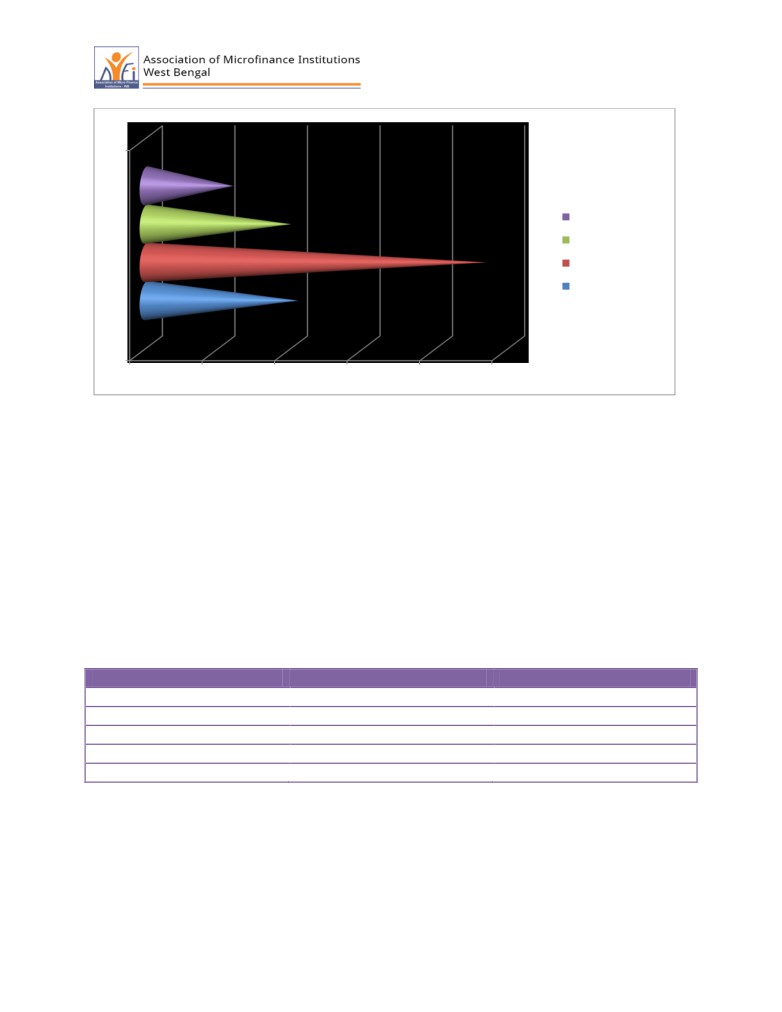

3.4: Amount of loan acquired by Microfinance users:

It is evident from table that 43% have borrowed loan amounts Rs. 60000 to 100000. And only

38% have borrowed the loan amount in between Rs.5000 - 60000. The loan amounted more than

Rs.100000 is 19%. Therefore, an over-borrowing scenario on the part of loan seekers may put

the sector in a considerable risk.

Table 3.4: Amount of loan acquired by Microfinance users

Loan amount taken Frequency

Percentage

Cumulative %

5000 -15000

0

0%

0%

15000 - 30000

15

15%

15%

30000 - 60000

23

23%

38%

60000 - 100000

43

43%

81%

100000-150000

8

8%

89%

150000 and above

11

11%

100%

12

Loan amount taken

50

40

30

20

10

0

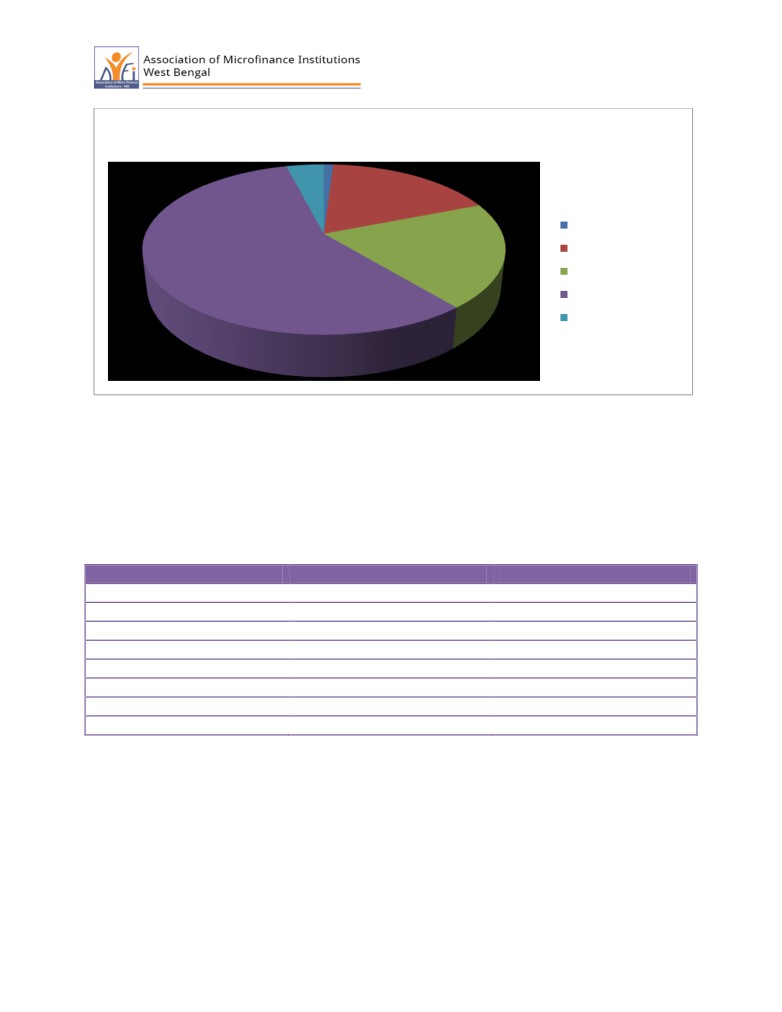

3.5: Number of Loan of the borrowers:

It is evident from the following table that there has been a spike in the average microfinance loan

ticket size along with a number of borrowers seeking loan from multiple entities. Only 35% of

the borrowers take loan from a single lender. The remaining 65% borrowers take loan from

multiple lenders. Therefore, some of the antecedents of over borrowing are information

asymmetries lending to normal hazards from both MFIs and borrowers and the consequence is

often over indebtedness lending to a crisis.

Table3.5: Number of loans acquired by the borrowers.

Number of loan taken

Frequency

Percentage

1

35

35%

2

54

54%

3

11

11%

Number of loan taken

1

2

3

13

3.6: Duration of installment:

The microfinance institutions are providing the installment facility in weekly, fortnightly and

monthly duration for repaying of loan. According to the survey report, it is found that 78% of

borrowers get duration of one week to repay the installments. Around 31% of the borrowers say

that they get duration of 15 days to repay the installment and 31% get duration of one month to

repay the installments. It is shown in the following table.

Table 3.6: Duration of installment

Duration of each installment

Weekly

78

78%

Fortnightly

31

31%

One month

31

31%

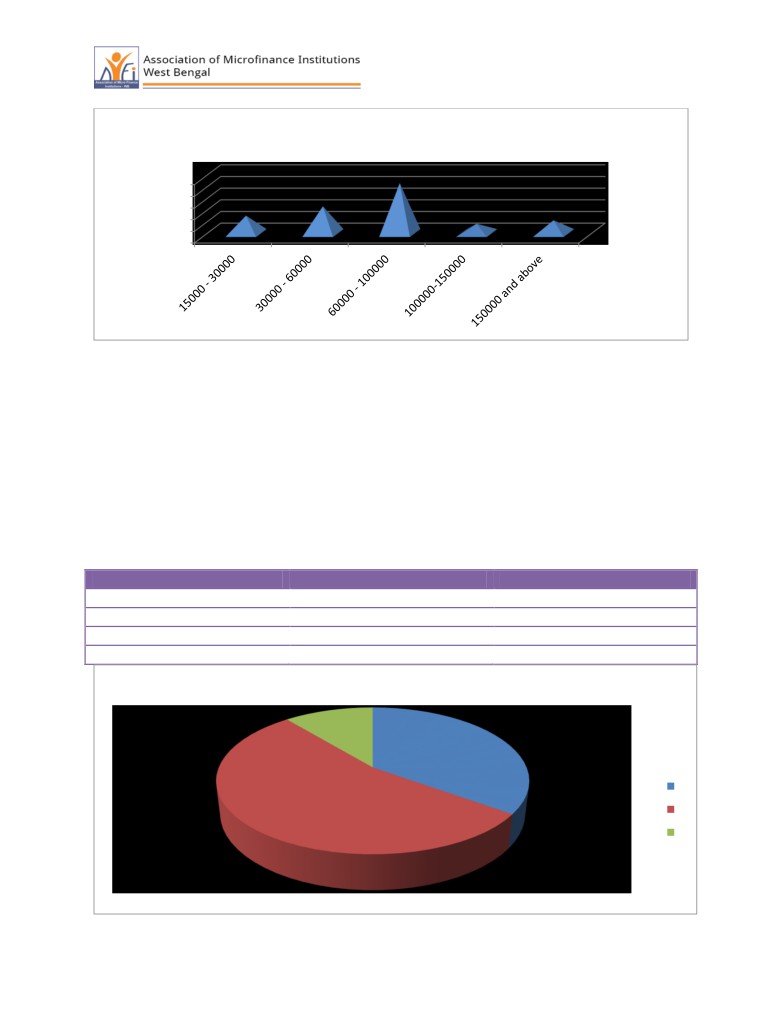

3.7: Investment Mechanism:

As far as investment mechanism of the slum microfinance users are concerned, it is seen that

most people make their investment in both the income generating activity and asset building

activity. 56% of the respondents use the loan amount in both the purposes simultaneously. It is

important to note that 10% of the respondents were not interested in making any investment and

use the loan amount in some unproductive purposes.

Table 3.7: Investment area

Investment Area

Respondents

Percentage

Income generating activity

28

28%

Asset building

6

6%

Both

56

56%

Other

10

10%

Total

100

100%

14

Investment Area

Income generating activity

Asset building

Both

others

3.8: Satisfaction Level:

The following table shows that 91% of the respondents are fully satisfied with the repayment of

loan. However, in respect of the loan amount the picture is quite different. Only 36% respondents

are fully satisfied with the loan amount. Therefore, MFIs are unable to meet the requirement of

the borrowers.

Table3.8: Satisfaction level with respect to uses of microfinance

Fully Satisfied

Partly satisfied

Not Satisfied

Loan size

36

39

25

Repayment

91

5

4

4. Economics of Microfinance users:

In this section we deal with economic conditions of micro finance users. The loan sources,

income, expenditure, savings, facilities availing and acquiring after and before joining

microfinance programmes.

4.1: Income level

It could be seen from table that maximum number of respondents earn Rs 15000 - Rs.20000

per month. Out of the sample size of 100, minimum number of respondents earns (only 7%) less

than Rs. 10000. The economic status of microfinance users are depicted by their earning

capacity. 72% of households earn income in the range of Rs.10000 to Rs.20000. Therefore, in

the slum area in Barasat Municipality, the microfinance has helped it users to raise their income

level.

Table4.1: Income Level

15

Present income level Frequency

Percentage

Cumulative

Up to 10000

7

7%

7%

10000-15000

26

26%

33%

15000-20000

39

39%

72%

More than 20000

28

28%

100%

Total

100

100%

Present income level

40

35

30

25

20

15

10

5

0

Up to 10000

10000-15000

15000-20000

More than 20000

4.2 Monthly Expenditure after joining MFI

The table

4.2 throws light on monthly expenditures of microfinance users. Majority of

respondents (37%) proclaimed that their family monthly expenditures lie between Rs.9000 to

Rs.10000. on the other hand only 13% of the respondents stated that their monthly expenditure is

under Rs.6000, whereas 23% household reported that they spend more than Rs.10000 monthly.

This means there is variation in monthly expenditure.

Table 4.2: Monthly expenditure after joining MFI

Monthly Consumption Frequency

Percentage

Cumulative

Up to 6000

13

13%

13%

6000-8000

27

27%

40%

9000-10000

37

37%

77%

More than 10000

23

23%

100%

Total

100

100%

100%

16

Monthly Consumption

40

35

30

25

20

15

10

5

0

Up to 6000

6000-8000

9000-10000

More than 10000

4.3: Monthly Savings before and after joining MFI

It could be seen from table 4.3 that after joining microfinance programme, presently, maximum

number of respondents save Rs.2000 to Rs.4000. out of the sample size of 100, very few number

of respondents save nothing (only one percent). The economic status of microfinance users are

also depicted by their saving behavior. Presently 99% borrowers are able to save some amount.

However, before joining MFI 23% household were unable to save any amount.

Table 4.3: Savings level

Monthly Savings Before joining MFI

After joining MFI

No savings

23

23%

1

1%

Upto 2000

61

61%

31

31%

2000 - 4000

11

11%

39

39%

Above 4000

5

5%

29

29%

17

70

60

50

40

Before joining MFI

After joining MFI

30

20

10

0

No savings

Upto 2000

2000 - 4000

Above 4000

5. Conclusion:

It is concluded that the maximum microfinance users in the slum area of Barasat

Municipality are married female. It is seen that 87% of the respondents are in the age

group of 18-45 years and 81% of the respondents are literate.

Before availing microfinance, the slum dwellers are engages in agriculture, daily wage

earners, small trading business etc. but after availing microfinance, they are engaged in

various income generating activities. Our study found that 56% of the respondents use the

microfinance loan for both income generating activities and asset building purpose

simultaneously.

The group members, friends, relatives are the major sources of information about the

availability of microfinance for them. The investment areas are identifies as self

employment, small business, retail shop, street vendor, etc.

It is also found the there is recurrence of loans by the borrowers. The parts of their

investment are on machine, raw materials, business assets, retail shops, and others.

However 10% of the borrowers have used the micro finance in unproductive purposes.

The major problem associated with microfinance lending is about the amount of loan

taken by the borrowers. 62% of the borrowers avail loans amounting Rs.60000 to 200000

and 65% of the borrowers are availing multiple loan.

18

The study clearly envisaged that there has been a spike in the average microfinance loan

ticket size, along with a number of borrowers seeking loans from multiple entities.

Therefore, the rapid growth of the microfinance industry is lending to a scenario of over-

borrowing on the part of loan seekers, putting the sector in a considerable risk.

Finally, the study conclude that in the absence of proper monitoring of both households and

MFIs by an independent authority, the intended objective of the RBI mandate would be seldom

achieved. We propose that the restrictions must be suitably amended for the creation of

conditions that promote free and fair competition between MFIs. With more information sharing

by the borrowers, MFIs can afford to take their own decisions. This would also enable

households to maintain client relationships with MFIs without being troubled by the number of

active loans.

Scope of the study

The current study was based on small sample size taken from only few households of Barasat

Municipality in North 24 parganas district of West Bengal. Therefore, the results cannot be

generalized to other district of West Bengal in the analytical terms. Further research done on a

bigger scale with large sample size could shed light on how microfinance activities affect the

average living standard of poor people in West Bengal.

The present study did not consider the reasons of motivation to join the microfinance program.

Another area that has not been investigated is the difficulties that the borrowers face to repay the

loan. These areas deserved to be studies in future.

There is also another field, which is neglected in our study that the supply gap of MFIs. Actually,

to what extent the MFIs are capable to deliver their service to the poor people. Further research

could be conducted in this area and for finding the reasons for the gap between demand and

supply in terms of microfinance services.

19

References:

Gibbons, D.S. & Meehan, J.W.

(2002). Financing Microfinance for Poverty Reduction.

Retrieved from http://www .microcreditsummit.org/papers/financing. pdf.

Government of India. 2008. “Report of the Committee on Financial Inclusion”. New Delhi.

http://sksindia.com/downloads/Report_Committee_Financial_Inclusion.pdf.

Planning Commission. 2009. “A Hundred Small Steps: Report of the Committee on Financial

Sector Reforms”. New Delhi: Sage.

http://planningcommission.nic.in/reports/genrep/rep_fr/cfsr_all.pdf.

Robinson, M. S.

(2001). The microfinance revolution: Sustainable finance for the poor.

Washington. DC: World Bank.

Rhyne, E.

(1998). The Yin and the Yang of Microfinance: Reaching the Poor and

FinancialSustainability. Microfinance Bulletin, 1998 (July), 6-8.

20

Questionnaire for clients/Beneficiaries

Annexure - I

A. Personal details:

Name of the

client

Client ID

District

Block

Branch

Religion

Hindu

Muslim

Christian

Others

Economic Status

APL

BPL

Employment

Housewife

Daily Wages

Own production

Service(tailoring/

status

unit

Repairing)

Grocery Shop

Street vendor

Others specify

B.

Demographic Details

Caste

GEN

SC

ST

OBC

Minority

Gender

Male

Female

Age Group

< 18

18+-25

25+ - 35

35+ - 46

46+ - 55

Marital

Single

Married

Divorce

Widow

Status

Education

Illiterate

Illiterate but

Primary

Secondary

Graduation

can sign

Post

Technical

Others

Graduation

Specify

Number of

Adult

Earning

Children

School

family

member

going

members

children

Income per

month

Consumption

Per month

21

C.

Membership Details

When did you Join MFI

How did you come to know

Media

Family

Friends &

MFI Staff/

Others

about MFI

members

Relatives

Agents

Who prompted you to join

Media

Family

Friends &

MFI Staff/

Others

the MFI

members

Relatives

Agents

Why did you join MFI

It adopts a hassle free process to sanction loan

Does not demand the security to sanction loan

Sanctions loan at relatively low rate of interest

It provides loan to low income people

Other people have increased their income through this

program

Incentive programs offered by it

Others advised me

Others (Specify)-

What Conditions /formalities

you are required to fulfill to

become a beneficiary and

Taken loan from MFI

Do you feel it is easy to get a

YES (give reason)

NO(give reason)

loan sanctioned from MFI

Staff members come

Interest rate high

themselves

Less documents

Difficult to understand the

required

process

No collateral

Lending Model is different

security required

Any Other

Any Other

How much loan have you

Less than Rs. 5,000

taken from MFI

Rs. 5,000 to Rs.10, 000

Rs. 10,000 to Rs. 20,000

Rs. 20,000 to Rs. 30,000

Rs. 30,000 to Rs. 50,000

Above Rs. 50,000

Number of existing loans

1

2

3

4

taken from MFI

Name of the MFI

Amount of installment for

each loan

Did you also take the loan

Yes

NO

from any other sources

Purpose of loan

Consumption

Agriculture

Animal Husbandry

22

Income generating activities

Asset Building

Emergencies

Children’s education

Any, Other, please specify

What kinds of services are

Loan transactions

provided by MFI

Women’s development programs

Local resource mobilization

Health, sanitation and drinking water

Training programmes

Others (Specify)

Are you satisfied with the

Yes

No

activities of MFI?

If not, list your major points

of dissatisfaction

How do you feel about the

Friendly

working environment of MFI?

Helpful

Co-operation among group members

Do not get chance to participate in the programs

Others (Specify)

How much of income do you

Less than 20%

feel has increased after

20%-----40%

joining MFI ?

40% --- 60%

60%--- 80%

80%---100%

100 & more than 100%

How much amount are you

saving per month?

How much amount are you

saving per month before

joining MFI

Main Purpose of savings (Give

Purpose of saving

Rank

in order of your Preference)

Social Security

Food Security

Education

Medical

Marriage

Festivals

Emergencies

Agriculture

Asset Building

Others

Do you find any positive

Yes

No

changes in the attitude of

23

your family members towards

you after joining MFI?

What kind of changes

Increase in respect

(positive/ negative) did you

Increase in co-operative

find?

attitude

Increase in sprit of

belonging

Adoption of negative

attitude

Degradation of status

What changes do you

Increase in self Confidence

perceive after joining MFI?

Increase in income

Increase in standard of

living

Increase in the education

level of children

Decision making power

Any other, please specify

How much you are satisfied

Policie

Fully sat

partly

Not

Cannot say

with the policies adopted by

s

satisfied

MFIs with regards to

Loan

Size

Repay

ment

How much you are satisfied

Fully

Partly satisfied

Not satisfied

Others

with the working of MFI

satisfied

What are the terms and

Interest rate

conditions evolved by group

Fine in case of default

with regard to repayments of

No. of defaults

loans?

Frequency of installment

Fixed term repayment

Can’t say

24